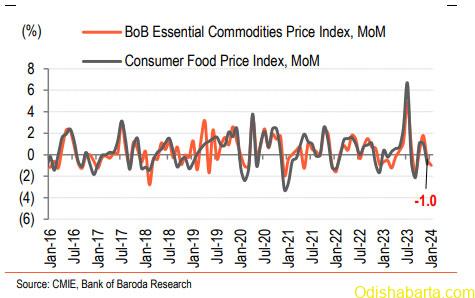

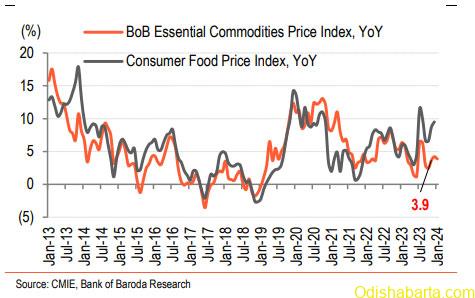

Analysis of BoB-ECI (Essential Commodities index ) by Dipanwita Mazumdar, Economist, Bank of Baroda for January 2024. The YoY increase was 3.9% while on a sequential basis it had fallen by 1%. For January we expect CPI inflation to come at less than 5%.

How prices look in Jan’24

BoB Essential Commodity Index (BoB ECI) has fallen by 1% in Jan’24, on a sequential basis. This is the

sharpest drop since Sep’23. The moderation in the index was broad based with most contribution

coming from correction in vegetable prices. Thus against this backdrop, we expect headline CPI to

settle at ~4.7% in Jan’24. Favourable base would also provide the desired cushion to this number.

However, what needs to be closely watched is the evolution of these numbers especially vegetable

prices. In Feb’24, it is already showing some tendency to return to its mean level, thus showing a slight

uptrend. But overall outlook seems favourable for inflation from the standpoint of demand-supply

dynamics, stable energy price and finely balanced revenue spending of the government, which in turn

might be positive for inflation in the near term.

To get an idea about the calculation of the index, refer to our previous edition of BoB ECI.

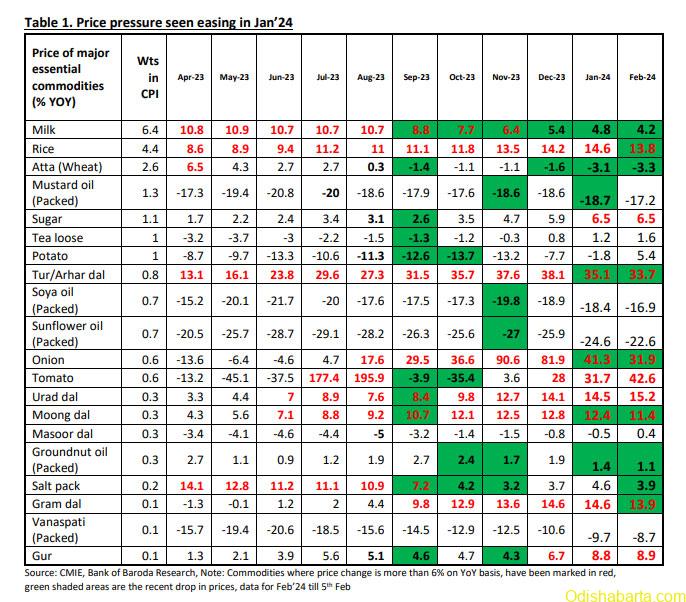

Price picture using BoB Essential Commodity Index:

- On MoM basis, BoB ECI fell by 1% in Jan’24 from 0.4% decline seen in Dec’23. This is the

sharpest pace of sequential decline in the index since Sep’23. 18 out of 20 commodities that

is captured in the index have registered a decline in Jan’24 compared to Dec’23. Among them,

sharpest correction was visible in case of Onion prices, which fell by 24.3% in Jan’24 from

14.8% decline seen in Dec’23. Other vegetables such as Tomato and Potato also continued its

downward spiral, falling by 14.9% and 5.1%, respectively, in Jan’24. Retail prices of all

categories of edible oils such as Groundnut, Mustard, Soya and Sunflower Oil, continued to

soften. Even price of pulses saw a correction with Tur/Arhar prices falling the most among

other categories of pulses, by 2.6% in Jan’24. Cereal prices moderated compared to last

month. Prices of Sugar and Gur also inched down. - On YoY basis, BoB ECI softened to 3.9% in Jan’24. 17 out of 20 commodities have registered

softening of prices. Notable ones include Onion, Tomato, some items of pulses such as

Tur/Arhar, Moong, cereals such as Atta (wheat) and other miscellaneous items of food such

as milk, sugar, tea etc. - For the first 5 days of Feb-24, BoB ECI has fallen by another 0.3% on MoM basis. However, as

seen in the vegetable prices data, much of the correction has already happened and the

difference between retail and wholesale price of these vegetables have also come down,

which suggests that much of the pass through has occurred. So the evolution of price data for

these volatile items, needs to be monitored carefully in the coming days

Figure 1: On MoM basis, BoB ECI has fallen by 1% in

Jan’24 from 0.4% decline seen in Dec’23

Figure 2: On YoY basis, it has moderated to 3.9%

So where is CPI print headed?

Based on the price dynamics, we expect CPI to be at ~4.7% inJan’24. This month the moderation in

prices have been broad based, with most significant correction visible in the vegetable prices. This

coupled with a favourable base of ~80bps will provide the desired comfort to inflation. For Q2FY24,

we expect CPI to settle below the 5% print.

However, since most of the correction in vegetable prices has already happened, as again in Feb’24

(first 5 days), prices are reverting to their normal level. Thus, it is important to look out for the

evolution of its trajectory. As for now, comfort on inflation comes from a favourable demand-supply

dynamics and stable input prices. Government’s adherence to fiscal prudence will also be positive on

part of inflation, as revenue spending has been finely managed.